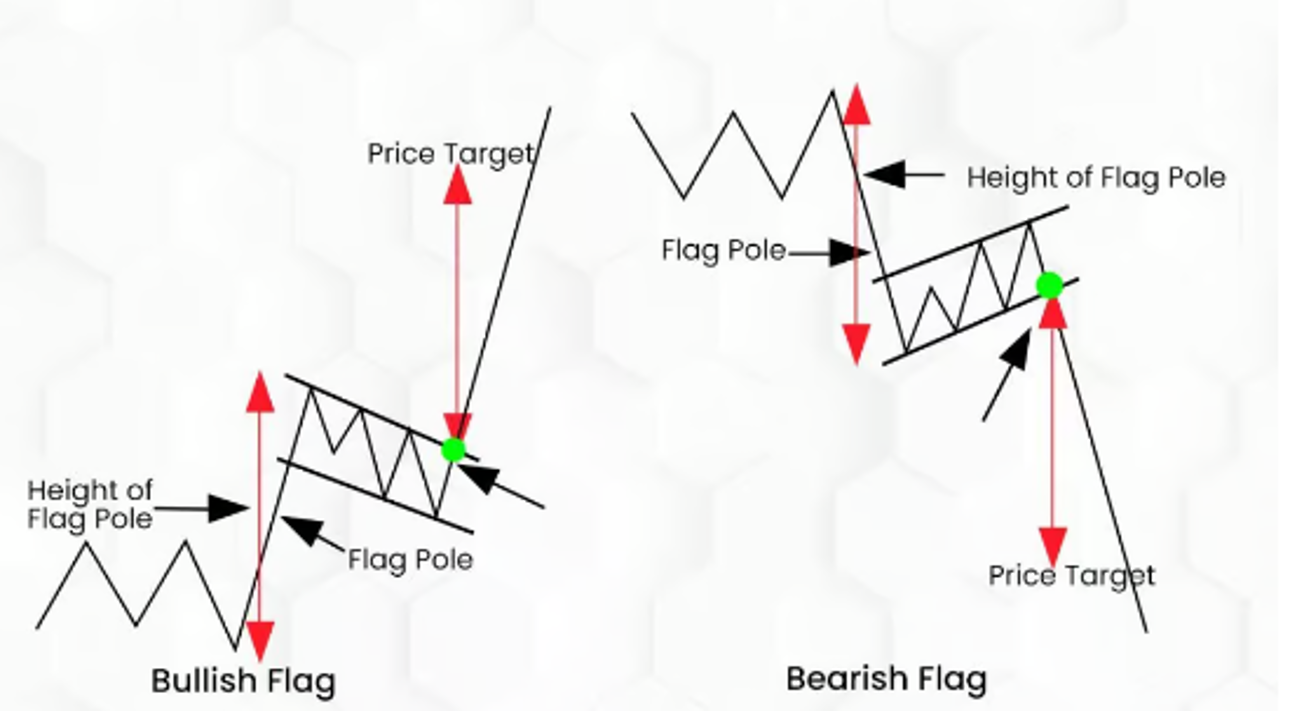

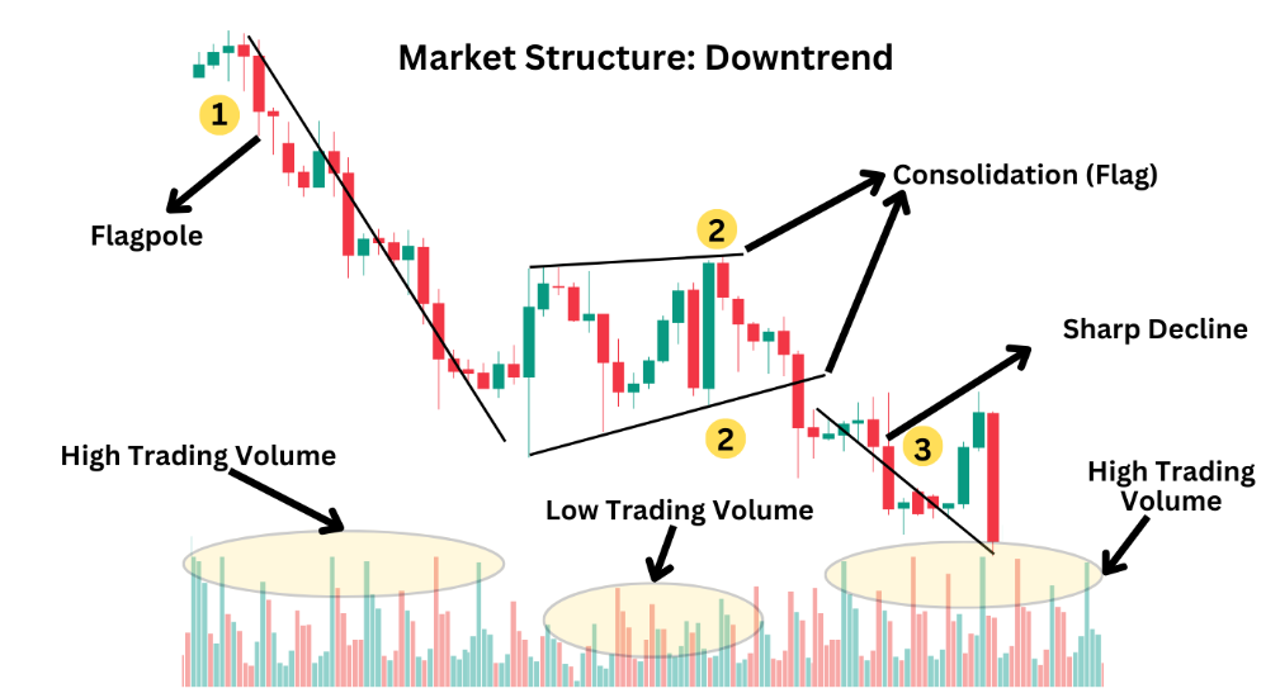

Flag patterns are powerful continuation patterns in technical analysis, indicating that the price trend is likely to resume after a brief period of consolidation. Flag patterns are characterized by a sharp price movement (referred to as the “flagpole”) followed by a consolidation phase that forms a small, rectangular-shaped “flag.”

There are two types of flag patterns:

• Bullish Flag: Forms after a strong upward price movement and indicates the continuation of the bullish trend.

• Bearish Flag: Forms after a sharp downward price movement and signals the continuation of the bearish trend.

________________________________________________________________________________________________________________________________________________________________

How Bullish and Bearish Flag Patterns Work for Buying and Selling

________________________________________________________________________________________________________________________________________________________________

Bullish Flag:

• Formation: A bullish flag occurs after a significant upward movement in price (the flagpole). The price then enters a consolidation phase, where it moves downward slightly or sideways in a narrow channel, forming the flag. The pattern is complete when the price breaks above the upper trendline of the flag, resuming the uptrend.

• Buying Signal: Traders look to buy when the price breaks above the upper trendline of the flag, which indicates the continuation of the bullish trend. The breakout confirms that the brief consolidation period has ended, and the price is ready to move higher.

• Selling Signal: In rare cases, if the price breaks below the lower trendline of the flag, it could signal a potential reversal of the uptrend. Traders might decide to sell or avoid entering a trade in such situations.

• Stop-Loss Consideration: A stop-loss order can be placed just below the lower trendline of the flag or near the previous support level to limit losses if the pattern fails.

Bearish Flag:

• Formation: A bearish flag forms after a sharp downward movement in price. Following this move, the price consolidates in a narrow upward or sideways channel, creating the flag shape. The pattern completes when the price breaks below the lower trendline of the flag, signalling the continuation of the bearish trend.

• Selling Signal: Traders look to sell when the price breaks below the lower trendline of the flag, indicating that the downtrend is likely to continue. The breakout confirms that the consolidation phase is over and the price is expected to drop further.

• Buying Signal: In some rare cases, the price may break above the upper trendline of the flag, indicating a potential reversal of the downtrend. However, bearish flags are predominantly continuation patterns, so a bullish breakout is less likely.

• Stop-Loss Consideration: A stop-loss order can be placed just above the upper trendline of the flag to limit potential losses in case of a false breakout or reversal.

Measuring Price Targets:

• In both bullish and bearish flags, the potential price target after a breakout can be estimated by measuring the height of the flagpole (the initial sharp move) and projecting it in the direction of the breakout. This method gives traders a rough idea of how far the price could move after the flag pattern resolves.

________________________________________________________________________________________________________________________________________________________________

The Psychology Behind Bullish and Bearish Flag Patterns

________________________________________________________________________________________________________________________________________________________________

Flag patterns reflect the psychological dynamics of the market during periods of consolidation after a strong price movement. Understanding the psychology behind these patterns can help traders make more informed decisions.

Bullish Flag Psychology:

• After a strong upward move (the flagpole), bullish traders who drove the price higher take a temporary pause. During this consolidation phase, the price moves slightly downward or sideways as some traders take profits. However, the selling pressure during this phase is weak, and the price remains within a narrow range, indicating that the market is still bullish.

• The upward breakout from the flag occurs when buyers regain control, confirming that the market sentiment remains bullish. The pattern shows that the pause in the trend was merely temporary and that the bulls are ready to push the price higher.

Bearish Flag Psychology:

• A bearish flag forms after a sharp downward movement in price, followed by a period of consolidation where the price moves slightly upward or sideways. This consolidation occurs as some traders who shorted the market take profits, leading to a slight recovery in price. However, the buying pressure during this phase is weak, and the price remains confined within a narrow channel.

• The downward breakout from the flag occurs when sellers regain control, confirming that the market sentiment remains bearish. The pattern signals that the brief consolidation was a temporary pause in the downtrend and that the bears are ready to push the price lower.

In both cases, flag patterns represent a pause in a strong trend, where the market temporarily consolidates before continuing in the direction of the original trend.

________________________________________________________________________________________________________________________________________________________________

How to Use Flag Patterns to Invest in the Stock Market

________________________________________________________________________________________________________________________________________________________________

Flag patterns provide traders with excellent opportunities to capitalize on strong trends. Here’s how readers can use bullish and bearish flag patterns in the stock market:

1. Trend Continuation Trading:

• Flag patterns are continuation patterns, so the most effective way to trade them is to follow the prevailing trend. In a strong bull market, bullish flags offer ideal entry points to ride the trend higher. In contrast, bearish flags provide opportunities to short-sell or exit long positions in a bear market.

• Traders should wait for a confirmed breakout from the flag before entering a trade. Jumping in too early during the consolidation phase can lead to losses if the breakout fails.

2. Volume Confirmation:

• The most reliable flag breakouts occur when accompanied by an increase in trading volume. Volume confirmation is critical because it indicates strong market participation in the direction of the breakout. Low-volume breakouts may result in false signals.

• To ensure a valid breakout, traders should look for a significant spike in volume when the price breaks above or below the flag.

3. Stop-Loss Orders:

• Proper risk management is essential when trading flag patterns. Traders should always place stop-loss orders to limit potential losses. For bullish flags, the stop-loss can be placed just below the lower trendline of the flag, while for bearish flags, the stop-loss can be placed just above the upper trendline.

• This approach helps protect traders from unexpected reversals or false breakouts.

4. Target Projection:

• A price target can be calculated by measuring the height of the flagpole (the initial sharp move) and projecting it from the breakout point. This gives traders a rough idea of how far the price is likely to move after the breakout and helps them set realistic profit-taking targets.

5. Swing Trading:

• Flag patterns are particularly useful for swing traders, as they represent short-term consolidation before a continuation in the trend. Swing traders can enter positions at the breakout point and ride the momentum of the trend for a short period before taking profits.

• A common approach for swing traders is to set trailing stop orders to lock in profits as the price moves in their favor.

6. Combining Flag Patterns with Other Indicators:

• Flag patterns are most effective when used in conjunction with other technical analysis tools. For instance, traders can combine flag patterns with indicators such as the Relative Strength Index (RSI) to determine whether the market is overbought or oversold before entering a trade.

• Moving averages, Fibonacci retracement levels, and MACD (Moving Average Convergence Divergence) can also be used to confirm the strength of the trend and identify potential support or resistance levels near the flag pattern.

7. Day Trading:

• Flag patterns can also be used for day trading in highly liquid markets. Day traders can enter trades at the moment of breakout and capture the quick price movements that often follow. However, it’s crucial for day traders to act quickly and manage risk tightly, as price movements after breakouts can be fast and volatile.

________________________________________________________________________________________________________________________________________________________________

Conclusion:

Bullish and bearish flag patterns are reliable continuation patterns that offer traders a clear indication of trend resumption after a brief consolidation phase. Whether you’re trading stocks, forex, or cryptocurrencies, understanding how to recognize flag patterns and trade breakouts can significantly enhance your success in the market. By using volume confirmation, setting appropriate stop-loss orders, and combining flag patterns with other technical indicators, traders can capitalize on these patterns to identify profitable opportunities and ride trends with confidence.. Thank you