News fresh from the oven..

Singapore’s Economic Outlook 2025: JB-SG Special Economic Zone, ASEAN Internet Growth, and Top Stock Picks

Comprehensive Company Analysis and Market Insights – Maybank Research Comprehensive Company Analysis and Market Insights Broker Name: Maybank Research Date

Johor-Singapore Special Economic Zone: Key Beneficiaries and Investment Opportunities

Comprehensive Analysis of Johor-Singapore Special Economic Zone Beneficiaries Comprehensive Analysis of Johor-Singapore Special Economic Zone Beneficiaries Prepared by: Maybank Research

ASEAN Internet Stocks 2025 Outlook: Fintech Boom Drives Growth for Grab, Sea, and GoTo

Deep Dive Analysis of Grab, Sea, and GoTo – A Comprehensive Report Deep Dive Analysis of Grab, Sea, and GoTo

Trending popular posts..

Dyna-Mac Delisting: Shareholders Exit as Company Faces Uncertain Future Post-M&A Shake-Up

Seatrium Set for More Share Buybacks, While SingPost Teases Special Dividends of SGD0.17-0.20!

Genting Malaysia’s New Casino: Positive Step but Limited Impact on Earnings

Seatrium Stock: Strong Q4 Performance and Growth Prospects in Offshore Energy

Swift Energy Technology Berhad IPO: Powering Growth with Industrial Innovation – What Investors Need to Know

Semiconductor Surge: Singapore Players Frencken and GVT Poised to Shine in 2025 Recovery

Singapore Alpha Picks: Top 14 Stocks Poised for Growth in 2025

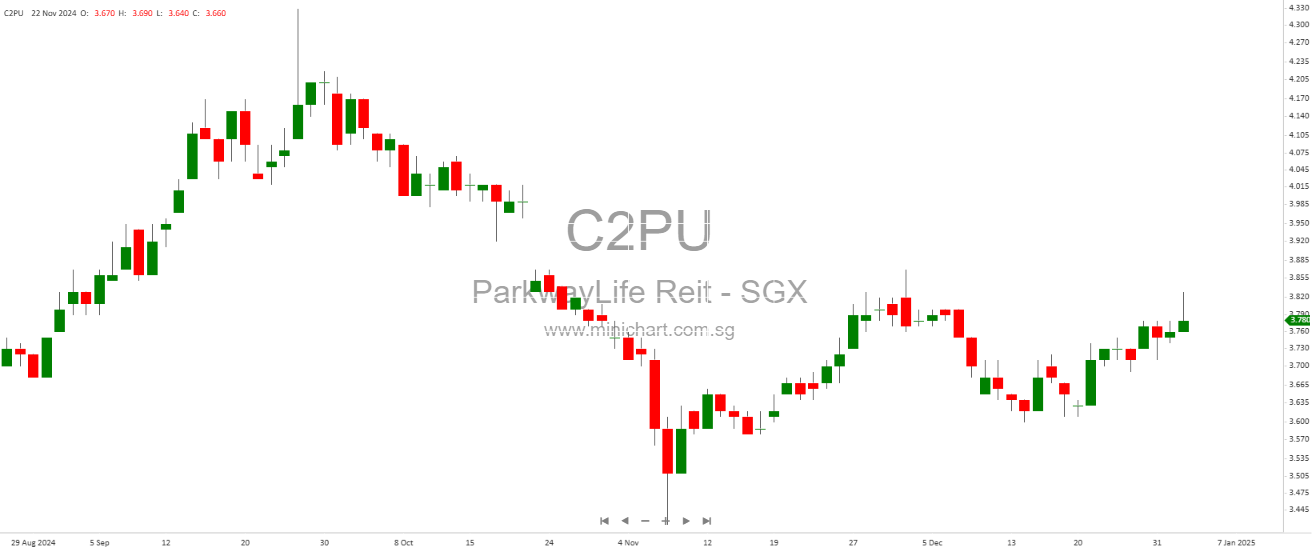

S-REITs Primed for a Comeback in 2025-2026; Parkway Life REIT Touted as ‘Dark Horse’

Digital Core REIT Faces Tenant Exit: DBS Sees ‘Opportunity to Capture Higher Value

Construction Boom Ahead: Analyst Highlights Top Picks and Trends for 2024

Singapore Stock Picks: Top 14 Outperforming Stocks for Q1 2025

Malaysia 2025 Market Outlook: Top Stocks and Themes for Domestic-Driven Growth

Dyna-Mac Delisting: Shareholders Exit as Company Faces Uncertain Future Post-M&A Shake-Up

Seatrium Set for More Share Buybacks, While SingPost Teases Special Dividends of SGD0.17-0.20!

Upcoming Singapore Dividends

| Company | Ex-date | Payment date | Particulars | Symbol Code | Yield | Close Price |

|---|---|---|---|---|---|---|

| PHILLIP SING INCOME ETF | 2025-01-09 | 2025-01-24 |

Rate: SGD 0.026 Per Security |

OVQ | 2.21% | $1.18 SGD |

| PHILLIP SGX APAC DIV REIT ETF | 2025-01-09 | 2025-01-24 |

Rate: USD 0.023 Per Security |

BYJ | 2.85% | $1.10 SGD |

| BANK OF CHINA HK SDR 1TO1 | 2025-01-13 | 2025-02-24 |

Rate: CNY 0.107633 Per Security |

HBND | 2.90% | $0.69 SGD |

| FRASER AND NEAVE, LIMITED | 2025-01-23 | 2025-01-28 |

Rate: SGD 0.04 Per Security |

F99 | 2.94% | $1.36 SGD |

| FRASERS PROPERTY LIMITED | 2025-01-23 | 2025-02-14 |

Rate: SGD 0.045 Per Security |

TQ5 | 4.79% | $0.94 SGD |

| PNE INDUSTRIES LTD | 2025-01-27 | 2025-02-14 |

Rate: SGD 0.02 Per Security |

BDA | 3.51% | $0.57 SGD |

| GOODLAND GROUP LIMITED | 2025-01-28 | 2025-02-14 |

Rate: SGD 0.005 Per Security Rate: SGD 0.00075 Per Security |

5PC | 4.83% | $0.12 SGD |

| KIMLY LIMITED | 2025-02-04 | 2025-02-14 |

Rate: SGD 0.01 Per Security |

1D0 | 3.03% | $0.33 SGD |

| THAI BEVERAGE PUBLIC CO LTD | 2025-02-06 | 2025-02-28 |

Rate: THB 0.47 Per Security |

Y92 | 3.22% | $0.57 SGD |

| LHN LIMITED | 2025-04-09 | 2025-05-30 |

Rate: SGD 0.01 Per Security |

41O | 2.00% | $0.50 SGD |

Minichart:

for winning in trading

Minichart is dedicated to help traders find the most explosive Stocks in Singapore, US, Hong Kong, China and Malaysia markets. We have an advanced stock scanning system for you to create your own Technical Analysis scanning formula. Register for a free account and try out now!

Join the Minichart community today!

See what our user says...

The trainer makes analysing the stock market so easy! The signals are easy to read and understand. I am starting to make more money in my trades now! Highly recommend!

Jimmy Koh

TraderThe various scanners that Minichart has blows me away. They are clearly the only player in the market with such innovative charting tools!

Mr Lee

EngineerI am impressed with Minichart's simple and easy to use platform. Looking at the stock market has never been easier with the various indicators and functions. Just take a look on the chart to determine if its good time to enter or exit!

Sally Yeo

HomemakerThe trainer makes analysing the stock market so easy! The signals are easy to read and understand. I am starting to make more money in my trades now! Highly recommend!

Jimmy Koh

TraderThe various scanners that Minichart has blows me away. They are clearly the only player in the market with such innovative charting tools!

Mr Lee

EngineerI am impressed with Minichart's simple and easy to use platform. Looking at the stock market has never been easier with the various indicators and functions. Just take a look on the chart to determine if its good time to enter or exit!

Sally Yeo

HomemakerThe trainer makes analysing the stock market so easy! The signals are easy to read and understand. I am starting to make more money in my trades now! Highly recommend!