Yangzijiang Shipbuilding (SGX: BS6) has shed nearly 30% of its market value since the United States proposed aggressive port fee measures in February targeting Chinese-built and Chinese-operated vessels, igniting investor concerns across the global shipping industry.

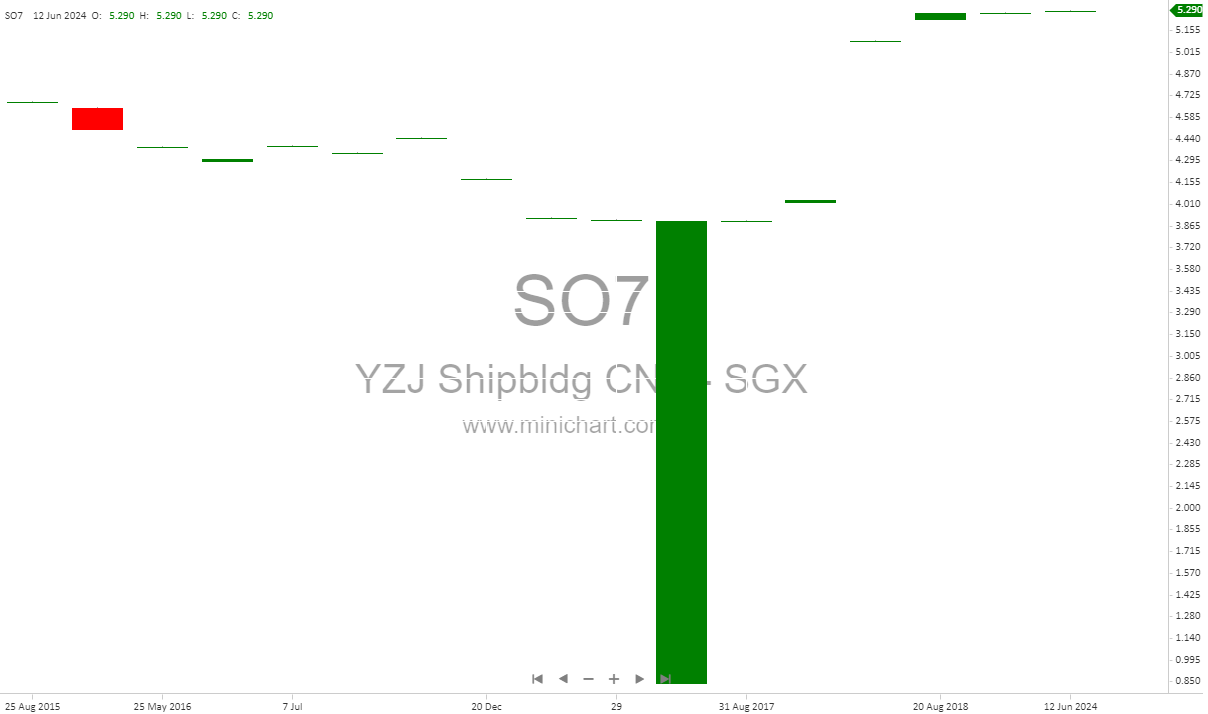

The Singapore-listed stock, once among the best performers on the SGX in 2024, soared to a 52-week high of S$3.30 on Feb 20, doubling from S$1.70 in May 2024. However, that rally was swiftly reversed after the Office of the United States Trade Representative (USTR) unveiled plans to impose fees of up to US$1.5 million on ships tied to China that call at US ports.

Sweeping Tariff Proposal

The USTR’s proposal includes:

-

US$1 million per vessel for Chinese-operated ships.

-

US$1.5 million per entry for non-Chinese carriers using Chinese-built ships.

-

Tiered fees depending on fleet composition:

-

US$1 million for fleets with >50% Chinese-built vessels,

-

US$750,000 for fleets with 25%–50%,

-

US$500,000 for fleets under 25%.

-

The move stems from an ongoing probe into China’s dominance in shipbuilding, where its global share surged from 5% in 1999 to over 50% in 2023.

Despite this regulatory headwind, Yangzijiang’s management has told analysts that no orders have been delayed or cancelled since the US announcement. However, it declined to provide updates to The Business Times on any recent developments or strategies to offset the US measures.

Market Reaction and Analyst Views

As of Tuesday, Yangzijiang’s shares closed 2.1% lower at S$2.32, making it the third-worst performer on the Straits Times Index (STI), which dipped 0.1% overall.

DBS Equity Research noted in a Mar 25 report that Yangzijiang is the only major listed shipbuilder in the region to be hit so hard, while Chinese peers and liners remain relatively stable. DBS maintains a target price of S$3.80, calling the plunge an “unwarranted sell-off” and encouraging investors not to “miss the boat.”

It added that key shipyards are booked for the next three years, and with tight global capacity driven by fleet renewal, energy transition, and defence demand, China remains vital to global shipbuilding.

UOB Kay Hian and other brokerages echoed this sentiment, noting that the US port fees – estimated at US$100 per container – could be passed on to shippers, minimising direct financial impact on the builders.

Industry’s Strategic Shift

To counter rising geopolitical risks, Chinese operators and shipbuilders are exploring options such as:

-

Rerouting shipping lanes,

-

Forming strategic alliances,

-

Relocating production bases out of China – part of the broader “China Plus One” strategy, now evolving into “China Plus N.”

Still, DBS cautioned that shipbuilding supply chains are not easily replicable, as they require access to competitive steel supply and skilled labour. While South Korean shipyards could attract new customers due to earlier delivery slots and lower prices, replacing China at scale remains challenging.

Beyond Politics: A Long-Term Risk

Notably, the port fee proposals were formulated before Donald Trump returned to office in January, highlighting bipartisan consensus in Washington on reducing reliance on China’s maritime dominance.

Some industry players speculate whether shifting to non-Chinese-built vessels and raising freight rates would help carriers avoid regulatory scrutiny — even if the end cost to shippers remains the same.

Ultimately, the pressure on Chinese shipbuilders like Yangzijiang may persist well beyond the current political cycle, prompting shipowners, carriers, and investors to recalibrate strategies to avoid prolonged fallout.

Thank you

Yangzijiang Shares Sink 30% as US Targets Chinese-Built Ships with Hefty Port Fees

Yangzijiang Shares Sink 30% as US Targets Chinese-Built Ships with Hefty Port Fees