Audience Analytics Announces 1-for-3 Bonus Issue to Reward Shareholders

Audience Analytics Limited, a Singapore-incorporated company, has unveiled plans for a bonus issue of up to 56,926,500 new ordinary shares. The proposed issuance will be on the basis of one bonus share awarded for every three existing shares held by shareholders as of a record date to be announced later. This initiative aims to recognize shareholder loyalty and enhance trading liquidity.

Key Highlights of the Proposed Bonus Issue

- Bonus Share Ratio: One (1) bonus share for every three (3) existing shares held.

- Total Issuance: Up to 56,926,500 new shares.

- Current Share Count: As of the announcement date, the company has 170,779,500 issued and paid-up shares with no treasury shares or subsidiary holdings.

- New Share Calculations: Based on the current share count, the bonus shares will represent approximately 33.3% of the existing number of shares and approximately 25% of the enlarged share capital post-issuance.

- Fully Paid Shares: The bonus shares will be issued as fully paid at no cost to shareholders, without utilizing the company’s reserves.

Rationale for the Bonus Issue

The company explained that the bonus issue is a strategic move to reward existing shareholders for their continued support. Additionally, increasing the number of issued shares is expected to enhance trading liquidity, broaden the shareholder base, and encourage greater investor participation in the company’s stock.

Regulatory Approvals and Compliance

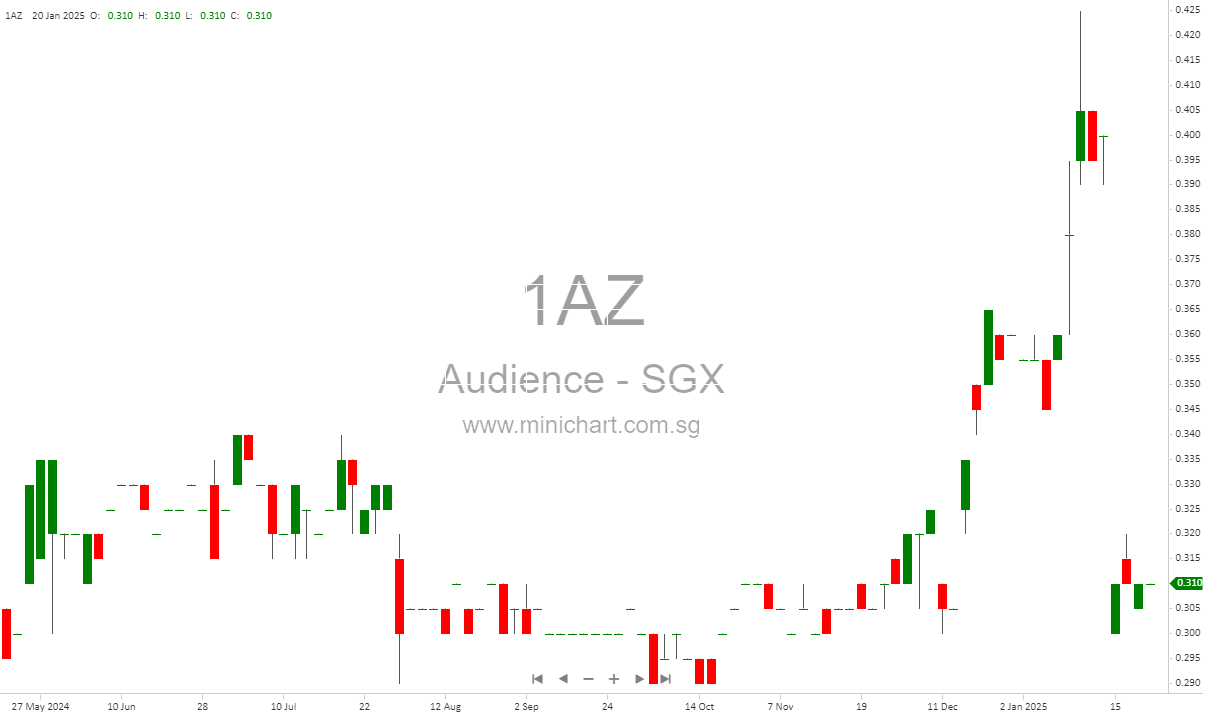

The bonus issue is contingent upon approval from the Singapore Exchange Securities Trading Limited (SGX-ST) for the listing and quotation of the new shares on the Catalist Board. Furthermore, the company asserted compliance with Rule 838 of the Catalist Rules, which mandates that the daily weighted average price of the shares, adjusted for the bonus issue, must not fall below S\$0.20 for the one-month period prior to the bonus application.

For illustrative purposes, the theoretical ex-bonus price (TEBP) was calculated at S\$0.2288, based on the lowest daily weighted average price of S\$0.3050 for the one-month period preceding December 20, 2024. The company expressed confidence that this threshold would be met at the time of application to the SGX-ST.

Impact on Share Awards

The company will adjust all outstanding share awards under its Shared Purpose and Prosperity Incentive Plan to reflect the bonus issue, ensuring alignment with its rules.

Director and Shareholder Interests

The board confirmed that none of the directors or substantial shareholders has any direct or indirect interest in the bonus issue, aside from their existing shareholdings in the company.

Potential Implications for Shareholders

Shareholders should note that the bonus shares, once issued, will rank equally with existing shares, except for rights, dividends, or distributions declared before the issuance date. The increase in issued shares may dilute the stock temporarily, but the enhanced liquidity and broadened shareholder base could positively influence the share price in the longer term.

Shareholders are advised to stay updated on the record date and necessary approvals, as these could impact their portfolio holdings. The announcement of the SGX-ST’s approval could be a key price-sensitive event to watch.

Cautionary Note

While the proposed bonus issue is subject to regulatory approval, investors are urged to exercise caution when trading the company’s shares. Consult a financial advisor or broker if you are uncertain about the actions to take.

Issued by: Datuk William Ng, Chairman and Managing Director, on December 20, 2024.

Disclaimer

This article is for informational purposes only and does not constitute financial advice. Shareholders and investors are advised to perform their own due diligence and consult professional advisors before making any investment decisions. The company’s sponsor, ZICO Capital Pte. Ltd., has reviewed this announcement but assumes no responsibility for its contents.