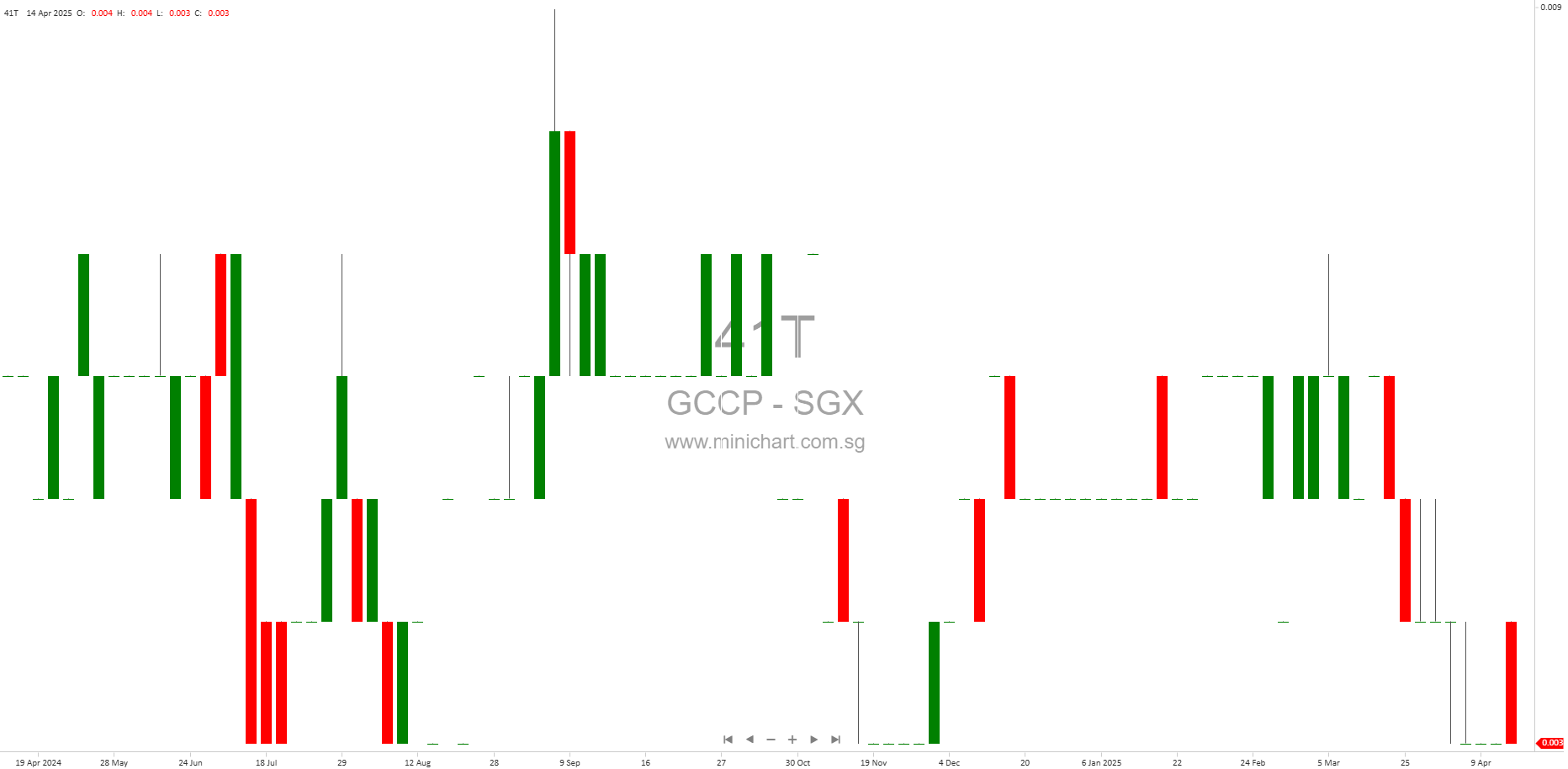

GCCP Resources Limited: Financial Analysis Report

Net Profit Decline: -RM8,851,136 (FY2024)

Business Description

GCCP Resources Limited is a company with its subsidiaries operating in an unspecified industry. The company’s core business operations, business segments, and geographic footprint are not explicitly stated in the report.

Industry Position and Competitors

The report does not provide information on the company’s position within the industry, its competitors, or market share.

Revenue Streams, Customer Base, Supply Chain, and Competitive Advantage

The report does not provide information on the company’s revenue streams, customer base, supply chain, or competitive advantage.

Financial Statement Analysis

Income Statement

The company incurred a net loss of RM8,851,136 for the financial year ended 31 December 2024.

The company incurred a net loss of RM5,336,650 for the financial year ended 31 December 2024 (for the Company only).

Balance Sheet

The Group’s current liabilities exceeded its current assets by RM12,469,690 as at 31 December 2024.

The Company’s current liabilities exceeded its current assets by RM7,079,293 as at 31 December 2024.

Cash Flow Statement

No information is provided on the cash flow statement.

Key Findings and Risks

The company’s ability to continue as a going concern is uncertain due to significant net losses and current liabilities exceeding current assets.

The auditor’s report expresses a disclaimer of opinion on the financial statements due to insufficient audit evidence.

Dividend and Earnings

No dividend information is provided. The company’s earnings have decreased, with a net loss of RM8,851,136 for the financial year ended 31 December 2024.

Important Information for Investor Action

The auditor’s report dated 5 April 2024 expressed a disclaimer of opinion on the consolidated financial statements of the Group and the statement of financial position and statement of changes in equity of the Company for the financial year ended 31 December 2023.

Special Activity or Action

No special activity or action is mentioned in the report to improve profitability.

Report Date and Financial Year

The report date is 14 April 2025, and it is reporting for the financial year ended 31 December 2024.

Recommendation

For Current Investors: Based on the report, we recommend SELLING the stock due to the significant uncertainty surrounding the company’s ability to continue as a going concern.

For Potential Investors: We recommend AVOIDING investment in this stock until the company’s financial situation improves and the auditor’s report expresses an opinion on the financial statements.

Disclaimer: This recommendation is based solely on the information provided in the report and should not be considered as investment advice. Investors should conduct their own research and consult with financial advisors before making any investment decisions.

GCCP Resources Limited: Independent Auditor’s Report for Financial Year Ended 31 December 2024 – Disclaimer of Opinion Due to Going Concern Uncertainty