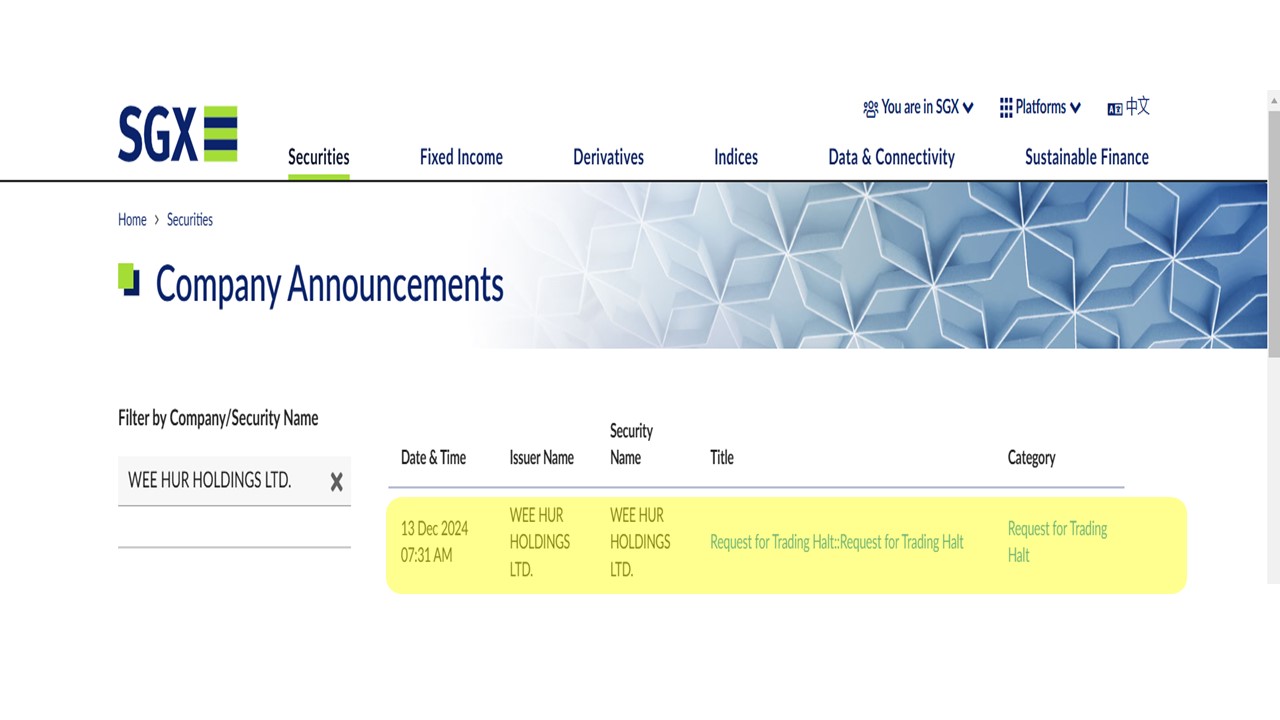

Wee Hur Holdings Ltd. (SGX:E3B) has requested a trading halt, prompting market speculation about potential developments within the company. While the company has not provided specific reasons for the halt, recent market chatter suggests several possibilities.

In October 2024, reports indicated that U.S. multifamily fund Greystar was acquiring GIC’s purpose-built student accommodation (PBSA) business in Australia for AUD 1.6 billion (SGD 1.4 billion). Wee Hur, which sold a 49.9% stake in its PBSA business to GIC in April 2022, was expected to retain a stake as GIC transferred ownership to Greystar. Following these reports, Wee Hur clarified that it was engaged in early-stage confidential discussions with a third party, which might or might not lead to a transaction.

Additionally, technical analyses have shown a strong bullish trend for Wee Hur’s stock, with some reports suggesting a potential upside of up to 87.5%.

Given these factors, the trading halt may be related to significant corporate actions, such as the potential sale of its Australian PBSA business or other strategic developments. Investors are advised to await official announcements from Wee Hur for precise information.

About Wee Hur

Wee Hur Holdings Ltd., established in 1980, is a Singapore-based investment holding company with diversified operations across construction, property development, workers’ dormitories, and purpose-built student accommodation (PBSA).

Financial Performance (2023):

- Revenue: SGD 224.84 million, a 4.15% increase from SGD 215.89 million in 2022.

- Net Profit: SGD 124.77 million, down from SGD 136.04 million in 2022.

- Earnings Per Share (EPS): 10.72 cents, up from 7.39 cents in 2022.

- Net Asset Value (NAV) Per Share: SGD 0.66, up from SGD 0.53 in 2022.

The revenue growth reflects the company’s resilience and effective project execution. The decline in net profit is attributed to the absence of gains from discontinued operations, which had significantly boosted the previous year’s profits. The increase in EPS and NAV per share indicates enhanced shareholder value.

Business Segments:

- Building Construction: Provides general building and civil engineering services for residential, commercial, industrial, institutional, and religious projects in both private and public sectors.

- Property Development: Engages in the development and sale of residential, industrial, and mixed-use properties in Singapore and Australia. Notable projects include Harvest@Woodlands and Parc Centros.

- Workers’ Dormitory: Operates purpose-built dormitories offering amenities such as recreational facilities, canteens, and retail shops to provide a conducive living environment for foreign workers.

- Purpose-Built Student Accommodation (PBSA): Develops and manages student accommodations, primarily in Australia, catering to local and international students. The company has established the Wee Hur PBSA Master Trust and launched the Y Suites brand to enhance its presence in this sector.

- Fund Management and Venture Capital: Offers fund management services and engages in venture capital activities to diversify its investment portfolio.

Recent Developments:

- PBSA Portfolio Sale: In April 2022, Wee Hur sold a 49.9% stake in its Australian PBSA business to GIC, Singapore’s sovereign wealth fund. Subsequently, in October 2024, reports indicated that U.S. multifamily fund Greystar was acquiring GIC’s PBSA business in Australia for AUD 1.6 billion. Wee Hur clarified that it was in early-stage discussions with a third party, which might or might not lead to a transaction.

- Leadership Changes: In August 2024, the company announced key management promotions, including the appointment of new CEOs for its construction and development subsidiaries, signaling a strategic focus on leadership renewal.

Company Background:

Founded in 1980 as a construction company, Wee Hur Holdings Ltd. has expanded its operations over the decades:

- 2008: Listed on the Singapore Exchange Mainboard.

- 2009: Ventured into property development with projects like Harvest@Woodlands.

- 2013: Entered the workers’ dormitory business with Tuas View Dormitory, housing 16,800 workers.

- 2014: Expanded overseas with property acquisitions in Brisbane, Australia, marking its foray into the Australian market.

- 2016-2017: Established the Wee Hur PBSA Master Trust and ventured into fund management, focusing on student accommodation assets.

- 2020: Launched the Y Suites brand, enhancing its PBSA operations.

Wee Hur’s diversified portfolio and strategic expansions underscore its commitment to growth and value creation across various sectors in Singapore and internationally.